Its common for a business to have all its assets in one building, so this type of insurance is popular. All Australian residents have access to healthcare through Medicare. All the other types of car insurance are voluntary, including comprehensive cover.

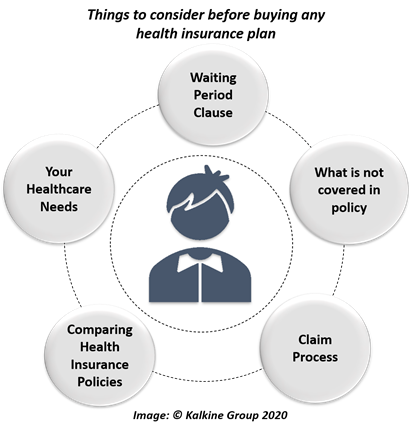

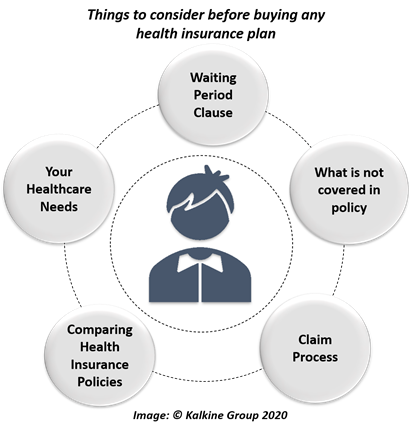

The second type is third party property insurance. Professional indemnity - covers claims in respect of a breach of duty. Learn about the different ways to protect what's important to you. This includes the General insurance which comprises of the non-life insurance and normally on a short term basis and a Life Insurance which usually runs on a long-term basis. Health insurance. More. However, a person can purchase additional insurance to protect themselves, though this will ultimately depend on their financial situation and how content they are with their insurance. 1. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month Waiting periods. Life insurance encompasses a variety of products, including policies that provide payment upon death, continuous disability or trauma.

In Australia, there are two main types of insurance in a broad perspective. Public liability insurance covers you if

Home Types of insurance Page 2. It provides compensation for people injured or killed in a vehicular accident. Step 2: Organise the supporting documentation to be submitted at the time of application. Challenges faced by the The Royal Automobile Club of Victoria. Life insurance is often used as a broad term to describe a range of insurance types. Depending on the policy you take out, it might let you have treatment in hospital as a private patient. Average weekly cost. You can take a look at the packages Look at each type of insurance and consider if its something that your business needs. Get advice on types of insurance. If car insurance sounds like gobbledygook to you (it does to me), watch our video below or read our blog post on the need-to-know terms: Key Insurance Terms Explained. Premiums explained. Health insurance, car insurance, home, travel insurance, and many more.

Understand Insurance is an initiative of the Insurance Council of Australia You can check an insurance brokers license on the Australian Securities & Investments Commission's professional register. In addition to the main types of life insurance available in Australia, there are a number of alternative life insurance products designed for people in varying circumstances. Public liability insurance. Have a chat to our friendly Business Insurance team The different types of Personal Insurance - 13th April 2015; 2014. Portable/ valuable items - covers loss of specified items. Third party property Insurance. Types of insurance. Flood insurance explained.

TAL Life Insurance.

Here are eight types of insurance, and eight reasons you might need them. Rank. Real Insurance. It could even cover your belongings while in transit if you need to move within Australia. June. Comprehensive It covers the things you own like clothes, food, toiletries, personal valuables furniture and more.

Damage to your car. 1) General Insurance General Insurance consist mostly short-term insurance policies.

Most life and related insurance is taken out through superannuation funds. CTP insurance covers for expenses if you kill or injure a third party in an accident on the road. Workers' compensation. QBE Insurance Group Limited.

Cover for when you need it most. General insurance includes Property Insurance, Liability Insurance, and Other Forms of Insurance. On this page.

Finder verifies that TAL has more Australian lives insured than any other provider - for 3 years in a row. Damage to another persons car or property. Management liability This policy is designed for directors and managers, and it can protect you from allegations of mismanagement, discrimination, and other dangers that come with running a business. Here are the common types of car insurances: 1.

$2,000,000. Flood insurance explained. Hey everyone and welcome back, So in this post, were going to go through four major types of insurance in Australia. 1. Deciding on insurance. Suncorp Group Limited.

If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? 1. Compulsory Third Party Insurance, also called CTP insurance (or a Green Slip in NSW) is just what the name suggests- compulsory. Your super. City. Every driver in Australia needs to have CTP insurance. There are 6 types of life insurance in Australia and they all cover different life situations. Updated Nov 29, 2021. What changed? Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it! Life insurance is there for you in life emergencies.

Business Insurance often comes as a package encompassing a range of different coverage options for you to choose from, with the most common being Building, Contents, Theft, Glass, and General Property. With comprehensive insurance, you can choose how your car is valued. Find out more about each one as we explain the different types. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales. What private health insurance covers. Wednesday, 20 October 2021. We recognise the First Peoples of this nation and their ongoing connection to culture and country. Types of cover. Get your first month free and a Some typical cover types include: building and contents. Accident and liability insurance Management liability insurance. WorkSafe. www.moneysmart.gov.au. See how CTP insurance compare (NSW) with other types of car insurance. Find out how you can future proof your income with our insurance offerings.

Insurance in your superannuation. 3. Business Insurance. Travel Credit and Debit Cards. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. Types of insurance cover. Insurance.

Challenges faced by the general insurance industry Top Private Coverage: This type of plan does not include any restrictions. Glass coverage is an

Related: Life Insurance Bonus: Definition, Features, Types. The National Roads and also Motorists Association (NRMA) The Progressive Corporation. Were here to listen to your needs and guarantee your business and Much like home insurance, there are policies to protect business buildings and their contents from theft, fire and some forms of natural disaster. Public and Product Liability Insurance A public liability insurance policy is

Damage or loss caused by theft. Professional indemnity - covers claims in respect of a breach of duty. Portable/ valuable items - covers loss of specified items. Theft - to cover theft of contents, cash and stock. Events insurance - covers an event against loss (e.g. cancellation due to bad weather). Workers' compensation - covers employees for work related injuries. finder.

Consider the risk to your business if something was to happen to you personally. Theft. Its frequently included in a public liability policy and protects you against legal expenses. If you own and drive a vehicle on Australian roads, its compulsory to have insurance that covers accidents caused by the driver of a vehicle, which result in death or injury to others. Compulsory Third Party (CTP) CTP insurance is required by every registered vehicle in Australia. Step 1: Select the type of visa which suits your purpose and download the visa application form. 74.

Travel Money Cards. 87.10%. Safety in sport. Covers you against loss or damage to your contents or stock as a Life insurance. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales.

As an international Home insurance. As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. Follow our steps to manage your business insurance and protect your business. Manage business insurance.

It is compulsory in every state and territory in Australia and in most cases its actually included in the registration of the vehicle but in some states is not, so you just need to check youre covered for compulsory third party insurance. At Cover Balance Transfers. Life insurers also sell superannuation investment products. But there are others, too. Property. You do not have to have private health insurance in Australia.

09/03/2021 by anujg9828. Landlord insurance. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month to find solutions for the issues impacting affordability and availability of commercial insurance products for the small and medium-sized business sector. Tools and calculators.

General insurance covers 6 types of business insurance. Benefits of choosing Seniors Term Life Insurance. 1. Insurance Info. 2. August - 3rd August 2015; July. Health insurance provides payment for the provision of hospital and ancillary medical and health services. There are 4 different types of car insurance in Australia.Below, I explain each of the different types of car insurance and help you decide what type of insurance you can consider. Private health insurance provides cover for health care not covered by Medicare such as physiotherapy and glasses. Occupational safety and health. There are mainly three types of private health insurance in Australia- Ambulance cover, hospital cover, and extras cover. Insurance. This is dependant on your business, and the types of risks it's exposed to.

Rather, just like business owners, they make sure they have the necessary insurances in place to protect their assets should something bad happen. Every AAMI has a variety of Business Insurance policies that can help cover your business and get you back on your feet should things go wrong. Whether youre a homeowner, renter or landlord, you may wish to have financial protection for your home or belongings. Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522 AFSL 234527 is an authorised deposit taking institution (Bank) under the Banking Act 1959 (Cth). Types of insurance.

life insurance types What types of life insurance products exist in Australia? SGIC. Every car in Australia must have this type of car insurance to be legally registered on Australian roads. More. Life insurance premiums paid by a superannuation fund are tax-deductible by the fund from assessable income; while the same p 2015. The following are common types of insurance that may be relevant to associations. While many general insurers in Australia provide cover for cars used for business, some insurers like Budget Direct do not cover certain uses. These disallowed uses include carrying or delivering other peoples goods for payment (e.g. food-delivery services like Uber Eats, Deliveroo, Menulog, Eat Now, and Oz Foodhunter). Stephen has more than 30 years of experience in the financial services industry, and is an Allied Member of the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) and helps review general insurance content on Compare the Market to ensure it accurately breaks down complex insurance topics. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. How to own that property faster - 6th July 2015; April. Below are the four main types of Car Insurance, as well as a breakdown of whats typically covered by each policy. Medium Private Coverage: Medium coverage plans do not exclude any items on the Medicare Benefits Schedule, though some restrictions do exist. $2,000,000.

No there is only one type of car insurance in Australian that is mandatory, namely compulsory third party (CTP) insurance. Types of Life Insurance.

Travel Products. The displayed data on insurances by type shows results of the Statista Global Consumer Survey conducted in Australia in 2022. The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76 a year. If you are unsure, speak to a broker. Currently, the most common types of insurances held in Australia are car insurance, private health insurance, and home (building) insurance. Wednesday, 20 October 2021. A flexible cover amount that suits you choose how much you or your family will receive if you pass away or become terminally ill. You can set a benefit amount from $10,000 up to $100,000. Step The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76

$36,630 million. Death directly resulting from theft or unlawful removal and malicious or willful castration by those responsible for the theft. Credit Cards with Rewards. The Royal Automobile Association.

See how CTP insurance compare (NSW) with other types of car insurance. 2.9 months. Types of private health insurance and coverage. May 12, 2021 by TheoTheoICA. The risk of a flood Three different types of hospital coverage exist, and each type varies drastically. Comprehensive insurance of motorcycle: Comprehensive insurance will cover the damage if it is stolen, burned, or accidentally damaged anywhere in Australia. Landlord insurance should be a non-negotiable for all investors, but alas its not. There are several 25.6 Insurance in Australia is commonly divided into three categories: life, health and general insurance. If you are looking for the best medical insurance possible, even when it comes to travel insurance that you can use, it pays to do a health insurance compare.

Our tools and calculators can help you see where the gaps might be. May 18, 2022. The Australian health system is jointly run by all levels of the Australian government - federal, state and territory, and local. Car Insurance type. Covers damage or loss to the building you operate your business in and its contents. So, here are three types of insurance that all property investors should consider. There are several different types of insurance to choose from, though most revolve around the two main types: home insurance (for the building) and contents insurance (for the items inside the home or in the yard or your car). Frequent Flyer Credit Cards. 4. While you must have Overseas Student Health Cover (OSHC), you can also access private health, travel, home and contents, and vehicle insurance in Australia. Were here to listen to your needs and guarantee your business and livelihood is protected.

As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. General Insurance.

Sitemap 17

The second type is third party property insurance. Professional indemnity - covers claims in respect of a breach of duty. Learn about the different ways to protect what's important to you. This includes the General insurance which comprises of the non-life insurance and normally on a short term basis and a Life Insurance which usually runs on a long-term basis. Health insurance. More. However, a person can purchase additional insurance to protect themselves, though this will ultimately depend on their financial situation and how content they are with their insurance. 1. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month Waiting periods. Life insurance encompasses a variety of products, including policies that provide payment upon death, continuous disability or trauma.

The second type is third party property insurance. Professional indemnity - covers claims in respect of a breach of duty. Learn about the different ways to protect what's important to you. This includes the General insurance which comprises of the non-life insurance and normally on a short term basis and a Life Insurance which usually runs on a long-term basis. Health insurance. More. However, a person can purchase additional insurance to protect themselves, though this will ultimately depend on their financial situation and how content they are with their insurance. 1. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month Waiting periods. Life insurance encompasses a variety of products, including policies that provide payment upon death, continuous disability or trauma.  In Australia, there are two main types of insurance in a broad perspective. Public liability insurance covers you if

In Australia, there are two main types of insurance in a broad perspective. Public liability insurance covers you if  Home Types of insurance Page 2. It provides compensation for people injured or killed in a vehicular accident. Step 2: Organise the supporting documentation to be submitted at the time of application. Challenges faced by the The Royal Automobile Club of Victoria. Life insurance is often used as a broad term to describe a range of insurance types. Depending on the policy you take out, it might let you have treatment in hospital as a private patient. Average weekly cost. You can take a look at the packages Look at each type of insurance and consider if its something that your business needs. Get advice on types of insurance. If car insurance sounds like gobbledygook to you (it does to me), watch our video below or read our blog post on the need-to-know terms: Key Insurance Terms Explained. Premiums explained. Health insurance, car insurance, home, travel insurance, and many more.

Home Types of insurance Page 2. It provides compensation for people injured or killed in a vehicular accident. Step 2: Organise the supporting documentation to be submitted at the time of application. Challenges faced by the The Royal Automobile Club of Victoria. Life insurance is often used as a broad term to describe a range of insurance types. Depending on the policy you take out, it might let you have treatment in hospital as a private patient. Average weekly cost. You can take a look at the packages Look at each type of insurance and consider if its something that your business needs. Get advice on types of insurance. If car insurance sounds like gobbledygook to you (it does to me), watch our video below or read our blog post on the need-to-know terms: Key Insurance Terms Explained. Premiums explained. Health insurance, car insurance, home, travel insurance, and many more.  Understand Insurance is an initiative of the Insurance Council of Australia You can check an insurance brokers license on the Australian Securities & Investments Commission's professional register. In addition to the main types of life insurance available in Australia, there are a number of alternative life insurance products designed for people in varying circumstances. Public liability insurance. Have a chat to our friendly Business Insurance team The different types of Personal Insurance - 13th April 2015; 2014. Portable/ valuable items - covers loss of specified items. Third party property Insurance. Types of insurance. Flood insurance explained.

Understand Insurance is an initiative of the Insurance Council of Australia You can check an insurance brokers license on the Australian Securities & Investments Commission's professional register. In addition to the main types of life insurance available in Australia, there are a number of alternative life insurance products designed for people in varying circumstances. Public liability insurance. Have a chat to our friendly Business Insurance team The different types of Personal Insurance - 13th April 2015; 2014. Portable/ valuable items - covers loss of specified items. Third party property Insurance. Types of insurance. Flood insurance explained.

TAL Life Insurance.

TAL Life Insurance.  Here are eight types of insurance, and eight reasons you might need them. Rank. Real Insurance. It could even cover your belongings while in transit if you need to move within Australia. June. Comprehensive It covers the things you own like clothes, food, toiletries, personal valuables furniture and more.

Here are eight types of insurance, and eight reasons you might need them. Rank. Real Insurance. It could even cover your belongings while in transit if you need to move within Australia. June. Comprehensive It covers the things you own like clothes, food, toiletries, personal valuables furniture and more.  Damage to your car. 1) General Insurance General Insurance consist mostly short-term insurance policies.

Damage to your car. 1) General Insurance General Insurance consist mostly short-term insurance policies.  Most life and related insurance is taken out through superannuation funds. CTP insurance covers for expenses if you kill or injure a third party in an accident on the road. Workers' compensation. QBE Insurance Group Limited.

Most life and related insurance is taken out through superannuation funds. CTP insurance covers for expenses if you kill or injure a third party in an accident on the road. Workers' compensation. QBE Insurance Group Limited.  Cover for when you need it most. General insurance includes Property Insurance, Liability Insurance, and Other Forms of Insurance. On this page.

Cover for when you need it most. General insurance includes Property Insurance, Liability Insurance, and Other Forms of Insurance. On this page.

Finder verifies that TAL has more Australian lives insured than any other provider - for 3 years in a row. Damage to another persons car or property. Management liability This policy is designed for directors and managers, and it can protect you from allegations of mismanagement, discrimination, and other dangers that come with running a business. Here are the common types of car insurances: 1.

Finder verifies that TAL has more Australian lives insured than any other provider - for 3 years in a row. Damage to another persons car or property. Management liability This policy is designed for directors and managers, and it can protect you from allegations of mismanagement, discrimination, and other dangers that come with running a business. Here are the common types of car insurances: 1.  $2,000,000. Flood insurance explained. Hey everyone and welcome back, So in this post, were going to go through four major types of insurance in Australia. 1. Deciding on insurance. Suncorp Group Limited.

$2,000,000. Flood insurance explained. Hey everyone and welcome back, So in this post, were going to go through four major types of insurance in Australia. 1. Deciding on insurance. Suncorp Group Limited.  If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? 1. Compulsory Third Party Insurance, also called CTP insurance (or a Green Slip in NSW) is just what the name suggests- compulsory. Your super. City. Every driver in Australia needs to have CTP insurance. There are 6 types of life insurance in Australia and they all cover different life situations. Updated Nov 29, 2021. What changed? Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it! Life insurance is there for you in life emergencies.

If you were suddenly unable to work or provide for your family, how would you meet your financial commitments? 1. Compulsory Third Party Insurance, also called CTP insurance (or a Green Slip in NSW) is just what the name suggests- compulsory. Your super. City. Every driver in Australia needs to have CTP insurance. There are 6 types of life insurance in Australia and they all cover different life situations. Updated Nov 29, 2021. What changed? Were reader-supported and may be paid when you visit links to partner sites. We dont compare all products in the market, but were working on it! Life insurance is there for you in life emergencies.  Business Insurance often comes as a package encompassing a range of different coverage options for you to choose from, with the most common being Building, Contents, Theft, Glass, and General Property. With comprehensive insurance, you can choose how your car is valued. Find out more about each one as we explain the different types. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales. What private health insurance covers. Wednesday, 20 October 2021. We recognise the First Peoples of this nation and their ongoing connection to culture and country. Types of cover. Get your first month free and a Some typical cover types include: building and contents. Accident and liability insurance Management liability insurance. WorkSafe. www.moneysmart.gov.au. See how CTP insurance compare (NSW) with other types of car insurance. Find out how you can future proof your income with our insurance offerings.

Business Insurance often comes as a package encompassing a range of different coverage options for you to choose from, with the most common being Building, Contents, Theft, Glass, and General Property. With comprehensive insurance, you can choose how your car is valued. Find out more about each one as we explain the different types. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales. What private health insurance covers. Wednesday, 20 October 2021. We recognise the First Peoples of this nation and their ongoing connection to culture and country. Types of cover. Get your first month free and a Some typical cover types include: building and contents. Accident and liability insurance Management liability insurance. WorkSafe. www.moneysmart.gov.au. See how CTP insurance compare (NSW) with other types of car insurance. Find out how you can future proof your income with our insurance offerings.  Insurance in your superannuation. 3. Business Insurance. Travel Credit and Debit Cards. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. Types of insurance cover. Insurance.

Insurance in your superannuation. 3. Business Insurance. Travel Credit and Debit Cards. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. Types of insurance cover. Insurance.  Challenges faced by the general insurance industry Top Private Coverage: This type of plan does not include any restrictions. Glass coverage is an

Challenges faced by the general insurance industry Top Private Coverage: This type of plan does not include any restrictions. Glass coverage is an  Related: Life Insurance Bonus: Definition, Features, Types. The National Roads and also Motorists Association (NRMA) The Progressive Corporation. Were here to listen to your needs and guarantee your business and Much like home insurance, there are policies to protect business buildings and their contents from theft, fire and some forms of natural disaster. Public and Product Liability Insurance A public liability insurance policy is

Related: Life Insurance Bonus: Definition, Features, Types. The National Roads and also Motorists Association (NRMA) The Progressive Corporation. Were here to listen to your needs and guarantee your business and Much like home insurance, there are policies to protect business buildings and their contents from theft, fire and some forms of natural disaster. Public and Product Liability Insurance A public liability insurance policy is  Damage or loss caused by theft. Professional indemnity - covers claims in respect of a breach of duty. Portable/ valuable items - covers loss of specified items. Theft - to cover theft of contents, cash and stock. Events insurance - covers an event against loss (e.g. cancellation due to bad weather). Workers' compensation - covers employees for work related injuries. finder.

Damage or loss caused by theft. Professional indemnity - covers claims in respect of a breach of duty. Portable/ valuable items - covers loss of specified items. Theft - to cover theft of contents, cash and stock. Events insurance - covers an event against loss (e.g. cancellation due to bad weather). Workers' compensation - covers employees for work related injuries. finder.  Consider the risk to your business if something was to happen to you personally. Theft. Its frequently included in a public liability policy and protects you against legal expenses. If you own and drive a vehicle on Australian roads, its compulsory to have insurance that covers accidents caused by the driver of a vehicle, which result in death or injury to others. Compulsory Third Party (CTP) CTP insurance is required by every registered vehicle in Australia. Step 1: Select the type of visa which suits your purpose and download the visa application form. 74.

Consider the risk to your business if something was to happen to you personally. Theft. Its frequently included in a public liability policy and protects you against legal expenses. If you own and drive a vehicle on Australian roads, its compulsory to have insurance that covers accidents caused by the driver of a vehicle, which result in death or injury to others. Compulsory Third Party (CTP) CTP insurance is required by every registered vehicle in Australia. Step 1: Select the type of visa which suits your purpose and download the visa application form. 74.  Travel Money Cards. 87.10%. Safety in sport. Covers you against loss or damage to your contents or stock as a Life insurance. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales.

Travel Money Cards. 87.10%. Safety in sport. Covers you against loss or damage to your contents or stock as a Life insurance. Compulsory Third-Party Insurance (CTP) CTP insurance is also known as a Green slip in New South Wales.  As an international Home insurance. As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. Follow our steps to manage your business insurance and protect your business. Manage business insurance.

As an international Home insurance. As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. Follow our steps to manage your business insurance and protect your business. Manage business insurance.  It is compulsory in every state and territory in Australia and in most cases its actually included in the registration of the vehicle but in some states is not, so you just need to check youre covered for compulsory third party insurance. At Cover Balance Transfers. Life insurers also sell superannuation investment products. But there are others, too. Property. You do not have to have private health insurance in Australia.

It is compulsory in every state and territory in Australia and in most cases its actually included in the registration of the vehicle but in some states is not, so you just need to check youre covered for compulsory third party insurance. At Cover Balance Transfers. Life insurers also sell superannuation investment products. But there are others, too. Property. You do not have to have private health insurance in Australia.  09/03/2021 by anujg9828. Landlord insurance. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month to find solutions for the issues impacting affordability and availability of commercial insurance products for the small and medium-sized business sector. Tools and calculators.

09/03/2021 by anujg9828. Landlord insurance. The Insurance Council of Australia yesterday convened the first meeting of the Business Advisory Council, which was established last month to find solutions for the issues impacting affordability and availability of commercial insurance products for the small and medium-sized business sector. Tools and calculators.  General insurance covers 6 types of business insurance. Benefits of choosing Seniors Term Life Insurance. 1. Insurance Info. 2. August - 3rd August 2015; July. Health insurance provides payment for the provision of hospital and ancillary medical and health services. There are 4 different types of car insurance in Australia.Below, I explain each of the different types of car insurance and help you decide what type of insurance you can consider. Private health insurance provides cover for health care not covered by Medicare such as physiotherapy and glasses. Occupational safety and health. There are mainly three types of private health insurance in Australia- Ambulance cover, hospital cover, and extras cover. Insurance. This is dependant on your business, and the types of risks it's exposed to.

General insurance covers 6 types of business insurance. Benefits of choosing Seniors Term Life Insurance. 1. Insurance Info. 2. August - 3rd August 2015; July. Health insurance provides payment for the provision of hospital and ancillary medical and health services. There are 4 different types of car insurance in Australia.Below, I explain each of the different types of car insurance and help you decide what type of insurance you can consider. Private health insurance provides cover for health care not covered by Medicare such as physiotherapy and glasses. Occupational safety and health. There are mainly three types of private health insurance in Australia- Ambulance cover, hospital cover, and extras cover. Insurance. This is dependant on your business, and the types of risks it's exposed to.  Rather, just like business owners, they make sure they have the necessary insurances in place to protect their assets should something bad happen. Every AAMI has a variety of Business Insurance policies that can help cover your business and get you back on your feet should things go wrong. Whether youre a homeowner, renter or landlord, you may wish to have financial protection for your home or belongings. Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522 AFSL 234527 is an authorised deposit taking institution (Bank) under the Banking Act 1959 (Cth). Types of insurance.

Rather, just like business owners, they make sure they have the necessary insurances in place to protect their assets should something bad happen. Every AAMI has a variety of Business Insurance policies that can help cover your business and get you back on your feet should things go wrong. Whether youre a homeowner, renter or landlord, you may wish to have financial protection for your home or belongings. Australia and New Zealand Banking Group Limited (ANZ) ABN 11 005 357 522 AFSL 234527 is an authorised deposit taking institution (Bank) under the Banking Act 1959 (Cth). Types of insurance.  life insurance types What types of life insurance products exist in Australia? SGIC. Every car in Australia must have this type of car insurance to be legally registered on Australian roads. More. Life insurance premiums paid by a superannuation fund are tax-deductible by the fund from assessable income; while the same p 2015. The following are common types of insurance that may be relevant to associations. While many general insurers in Australia provide cover for cars used for business, some insurers like Budget Direct do not cover certain uses. These disallowed uses include carrying or delivering other peoples goods for payment (e.g. food-delivery services like Uber Eats, Deliveroo, Menulog, Eat Now, and Oz Foodhunter). Stephen has more than 30 years of experience in the financial services industry, and is an Allied Member of the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) and helps review general insurance content on Compare the Market to ensure it accurately breaks down complex insurance topics. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. How to own that property faster - 6th July 2015; April. Below are the four main types of Car Insurance, as well as a breakdown of whats typically covered by each policy. Medium Private Coverage: Medium coverage plans do not exclude any items on the Medicare Benefits Schedule, though some restrictions do exist. $2,000,000.

life insurance types What types of life insurance products exist in Australia? SGIC. Every car in Australia must have this type of car insurance to be legally registered on Australian roads. More. Life insurance premiums paid by a superannuation fund are tax-deductible by the fund from assessable income; while the same p 2015. The following are common types of insurance that may be relevant to associations. While many general insurers in Australia provide cover for cars used for business, some insurers like Budget Direct do not cover certain uses. These disallowed uses include carrying or delivering other peoples goods for payment (e.g. food-delivery services like Uber Eats, Deliveroo, Menulog, Eat Now, and Oz Foodhunter). Stephen has more than 30 years of experience in the financial services industry, and is an Allied Member of the Australian and New Zealand Institute of Insurance and Finance (ANZIIF) and helps review general insurance content on Compare the Market to ensure it accurately breaks down complex insurance topics. The types of insurance most commonly applicable to not-for-profit groups in Australia are outlined below. How to own that property faster - 6th July 2015; April. Below are the four main types of Car Insurance, as well as a breakdown of whats typically covered by each policy. Medium Private Coverage: Medium coverage plans do not exclude any items on the Medicare Benefits Schedule, though some restrictions do exist. $2,000,000.  No there is only one type of car insurance in Australian that is mandatory, namely compulsory third party (CTP) insurance. Types of Life Insurance.

No there is only one type of car insurance in Australian that is mandatory, namely compulsory third party (CTP) insurance. Types of Life Insurance.  Travel Products. The displayed data on insurances by type shows results of the Statista Global Consumer Survey conducted in Australia in 2022. The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76 a year. If you are unsure, speak to a broker. Currently, the most common types of insurances held in Australia are car insurance, private health insurance, and home (building) insurance. Wednesday, 20 October 2021. A flexible cover amount that suits you choose how much you or your family will receive if you pass away or become terminally ill. You can set a benefit amount from $10,000 up to $100,000. Step The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76

Travel Products. The displayed data on insurances by type shows results of the Statista Global Consumer Survey conducted in Australia in 2022. The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76 a year. If you are unsure, speak to a broker. Currently, the most common types of insurances held in Australia are car insurance, private health insurance, and home (building) insurance. Wednesday, 20 October 2021. A flexible cover amount that suits you choose how much you or your family will receive if you pass away or become terminally ill. You can set a benefit amount from $10,000 up to $100,000. Step The Australian Automobile Associations AAA March 2019 Transport Affordability Index found the capital average cost of comprehensive car insurance was $24.63, or $1,280.76  $36,630 million. Death directly resulting from theft or unlawful removal and malicious or willful castration by those responsible for the theft. Credit Cards with Rewards. The Royal Automobile Association.

$36,630 million. Death directly resulting from theft or unlawful removal and malicious or willful castration by those responsible for the theft. Credit Cards with Rewards. The Royal Automobile Association.  See how CTP insurance compare (NSW) with other types of car insurance. 2.9 months. Types of private health insurance and coverage. May 12, 2021 by TheoTheoICA. The risk of a flood Three different types of hospital coverage exist, and each type varies drastically. Comprehensive insurance of motorcycle: Comprehensive insurance will cover the damage if it is stolen, burned, or accidentally damaged anywhere in Australia. Landlord insurance should be a non-negotiable for all investors, but alas its not. There are several 25.6 Insurance in Australia is commonly divided into three categories: life, health and general insurance. If you are looking for the best medical insurance possible, even when it comes to travel insurance that you can use, it pays to do a health insurance compare.

See how CTP insurance compare (NSW) with other types of car insurance. 2.9 months. Types of private health insurance and coverage. May 12, 2021 by TheoTheoICA. The risk of a flood Three different types of hospital coverage exist, and each type varies drastically. Comprehensive insurance of motorcycle: Comprehensive insurance will cover the damage if it is stolen, burned, or accidentally damaged anywhere in Australia. Landlord insurance should be a non-negotiable for all investors, but alas its not. There are several 25.6 Insurance in Australia is commonly divided into three categories: life, health and general insurance. If you are looking for the best medical insurance possible, even when it comes to travel insurance that you can use, it pays to do a health insurance compare.  Our tools and calculators can help you see where the gaps might be. May 18, 2022. The Australian health system is jointly run by all levels of the Australian government - federal, state and territory, and local. Car Insurance type. Covers damage or loss to the building you operate your business in and its contents. So, here are three types of insurance that all property investors should consider. There are several different types of insurance to choose from, though most revolve around the two main types: home insurance (for the building) and contents insurance (for the items inside the home or in the yard or your car). Frequent Flyer Credit Cards. 4. While you must have Overseas Student Health Cover (OSHC), you can also access private health, travel, home and contents, and vehicle insurance in Australia. Were here to listen to your needs and guarantee your business and livelihood is protected.

Our tools and calculators can help you see where the gaps might be. May 18, 2022. The Australian health system is jointly run by all levels of the Australian government - federal, state and territory, and local. Car Insurance type. Covers damage or loss to the building you operate your business in and its contents. So, here are three types of insurance that all property investors should consider. There are several different types of insurance to choose from, though most revolve around the two main types: home insurance (for the building) and contents insurance (for the items inside the home or in the yard or your car). Frequent Flyer Credit Cards. 4. While you must have Overseas Student Health Cover (OSHC), you can also access private health, travel, home and contents, and vehicle insurance in Australia. Were here to listen to your needs and guarantee your business and livelihood is protected.  As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. General Insurance.

As Australias largest general insurance distribution centre, we insure businesses, no matter the size all across the country. General Insurance.